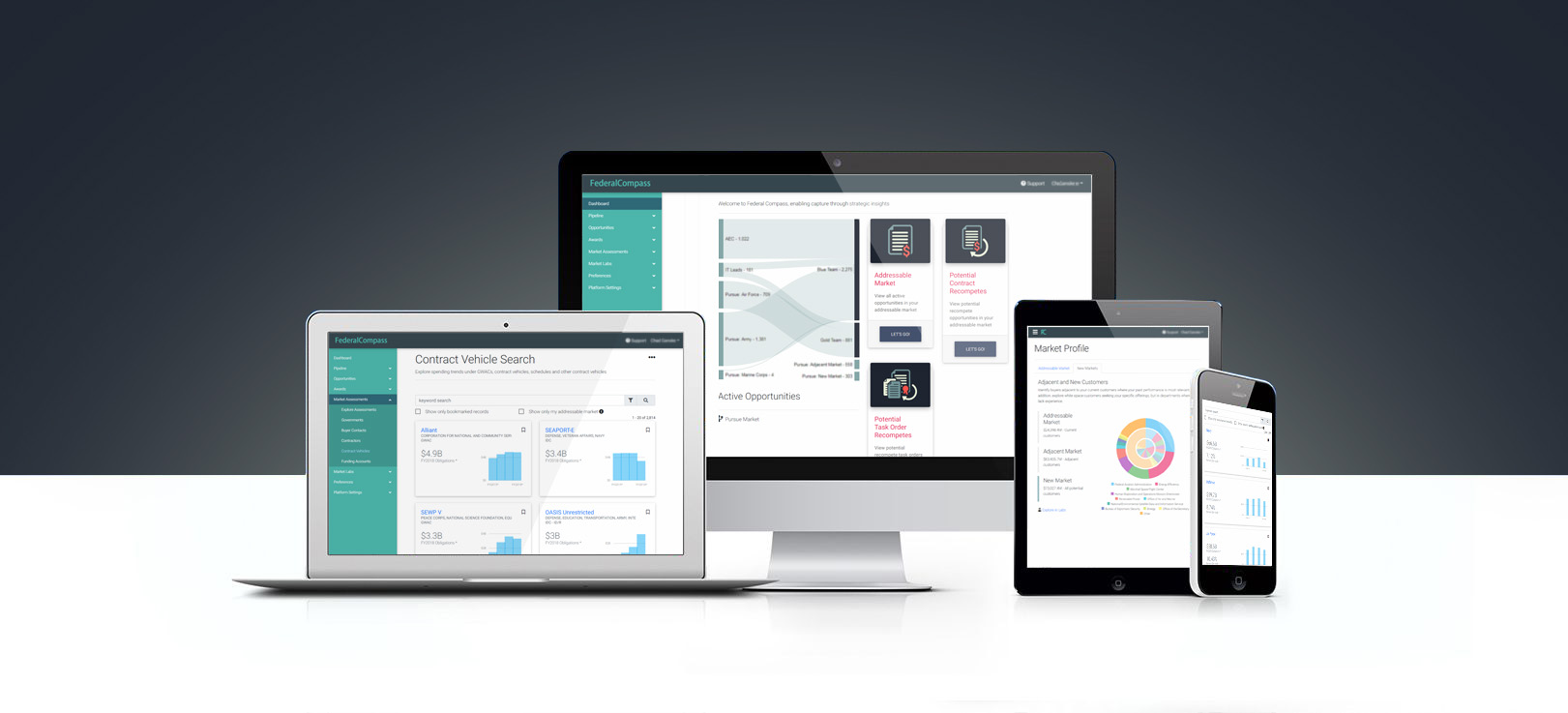

Solutions for Market Intelligence

for Federal Contractors

Who’s Buying What I’m Selling?

With personalized markets, skip over the noise and dive right into what matters most; the things you sell and the customers you sell to.

Identify Adjacent and New Customers

Research that leads to action; identify pathways to new customers, and explore end-users who are buying exactly what you’re selling.

Pathways to your Customer

Secondary competition has become a dominant pathway for federal spending in many industries. Are you positioned to compete for these dollars? Have you identified which vehicles you should be pursuing?