What Are GWACs and Why Do They Matter?

In an effort to procure IT products and services in a more efficient manner, the Federal government created Government-Wide Acquisition Contracts (GWAC). GWACs are administered and managed by the General Services Administration (GSA), National Institutes of Health, and NASA, in an effort to reduce friction and delays when federal departments look to acquire technology-related goods and services.

Using a self-scoring evaluation system, federal contractors assess the products and services they provide which determines if they are eligible for certain federal government contracts. Think of the Olympics. There are a lot of pre-qualifiers that need to happen before getting on the big stage.

The scoring system begins with the self-evaluation and then, those who meet the initial criteria, are further evaluated to determine if they qualify to get on the desired GWAC. This streamlined process allows for one, in-depth evaluation rather than multiple for the same vendor. This saves agencies time and money when it comes to procuring IT products and services under critical deadline pressure.

Why Do GWACs Matter?

In short, GWACs are the best-in-class contracts for federal agencies to choose from when they need IT products and services. Unlike GSA schedules, GWACs are not continuously open for new vendors. There is a vetting process and once that window has closed, it remains closed for a set period of time, roughly a decade. Though on-ramp windows are becoming increasingly popular, these windows offer no relief from the rigor of obtaining a prime position. This means that contractors on a GWAC have a much smaller competitive pool when compared to SAM.gov, where a large number of contractors are monitoring and pursuing competition. This means, if one of your larger customers were to move to GWACs to fulfill their needs and you are not able to get on, how impactful would that be for your bottom line?

Having the capability to access opportunities only a select few can see is an extremely powerful advantage. Opportunities available through GWACs are not available on SAM.Gov or open to the general public. They are unique opportunities that are essentially tailored to your business and what it can provide. However, GWACs are an extremely competitive niche, and just being on this pathway, does not mean that success is guaranteed. Winning a contract is even harder. Roughly 10% of contractors on GWACs end up capturing the majority of spending. So after pouring countless time and resources into qualifying to be on a GWAC, success is determined by contractors' post-award processes.

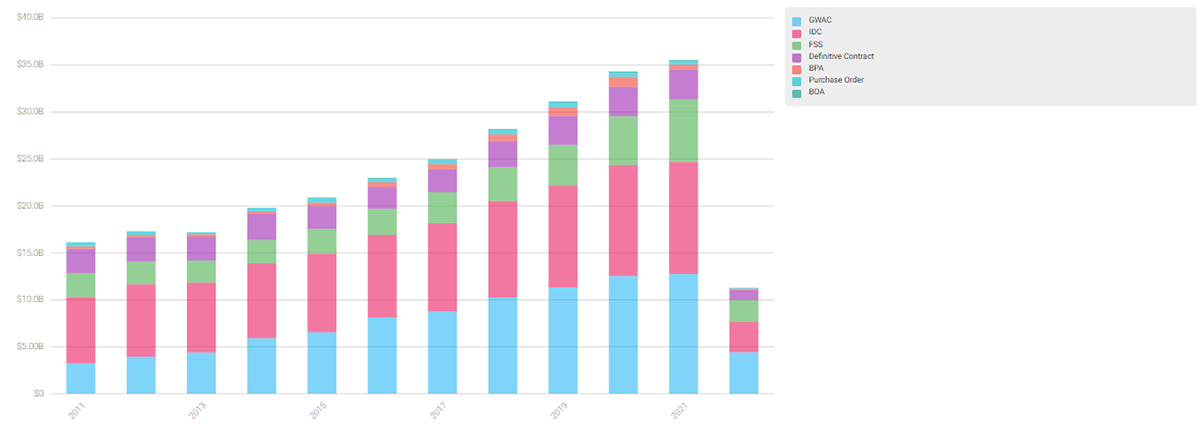

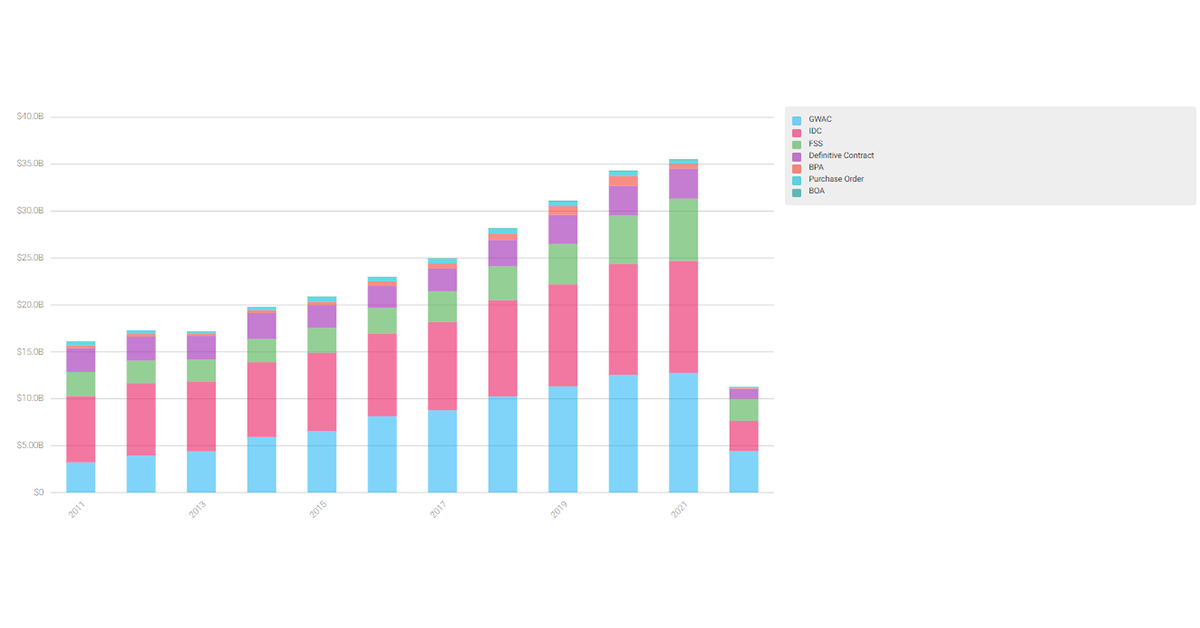

(Federal Compass Federal Purchasing Breakdown of NAICS Codes 541512 & 541511)

When looking at a breakdown of how the federal government purchased, goods and services over the past 10 years, GWACs are on the rise. In 2011, roughly 2.68 billion dollars were contracted through GWACs. 10 years later in 2021, that number rose to 12.75 billion dollars. As a federal contractor, it may no longer be a question of if you can win a contract. The new question may be, what happens to your business if your customers move to GWACs and you are not able to get on?

Which GWACs Matter Now

As it stands, there are 730 task orders with over 10 billion dollars in obligated sales for contractors on GWACs dating back to 2018. Favored by some federal agencies more than others, when GWACs become available for recompetes, the buzz around them becomes palpable. For this are we going with all awards or only those that have yet to expire?

Designed for certified 8(a) small businesses, 8(a) STARS II and STARS III run on five-year base periods and average approximately 5.2 proposals for each competitive procurement. These GWACs are intended to promote small business utilization by federal agencies when purchasing IT services or IT service-based solutions.

The only set-aside exclusive for Service-Disabled, Veteran-Owned Small Businesses (SDVOSB). Task orders run for five years with a five-year option to plan for long-term growth and to continually fulfill important IT-related needs. There are multiple contract types available, including firm-fixed-price, cost-reimbursement, time-and-materials, and labor-hour.

As the advancements of artificial intelligence (AI) continue to grow, Alliant 2 allows federal agencies to better incorporate AI, distributed ledger technology, and robotic process automation (RPA) throughout their departments. Alliant 2 is a five-year contract with one five-year option. With a ceiling worth roughly $50 billion and approximately 53 awardees, Alliant 2 is extremely competitive but very rewarding for contractors who are able to win on this GWAC.

Built on the success of 8(a) STARS and VETS 2, Polaris is the newest member of the GWAC family. The goal is to expand industry partner bases, increase access to emerging technologies, and streamline the proposal submission process. Predominantly centered around small businesses, Polaris is aimed to help increase the level of competitiveness amongst these types of businesses.

CIO-SP3 helps small businesses sell their IT products and services to the Department of Health and Human Services. This GWAC ran for 10 years and had a $20 billion contract holder. Currently, CIO-SP4 is in the onboarding phase and will be rolled out in what appears to be 2023. CIO-SP3 has been extended for another year but in three-month increments.

Why GWACs Are Important for Your Success

GWACs help federal agencies reduce the amount of time and effort spent on procurement and allow federal contractors to more efficiently and effectively sell their products and services to the government. The streamlined and assisted acquisition unique to GWACs creates an attractive alternative for federal agencies.

Once the initial investment of time and resources has paid off and a contractor is on a GWAC, sustainable growth and a stronger pathway to success are on the horizon. But for smaller contractors who may not have the resources, partners, or consultants to compete for contract vehicles, a highly competitive market becomes all the more complicated once their customers begin considering a transition to GWACs. This is why research is so crucial for federal contractors. When improper or inaccurate data is followed, contractors can spend months or even years chasing unwinnable opportunities. Whereas, if they had accurate information and insights from the beginning, they could have saved that time and resources chasing opportunities and contract vehicles that they could actually win.

GWACs are quickly becoming an essential part of any contractor’s portfolio. A ten-year trend has proven that the government’s migration to GWACs continues at a constant pace. Sustained growth for IT service and products contractors will soon require access to and success on a GWAC.

Federal Compass provides federal contractors with the most comprehensive market intelligence platform available. Included in our market intelligence is a level of customization that is unparalleled in the federal contracting market. Opportunities and information are tailored specifically to you, your business, and your market so you can find opportunities and information that are more useful and actionable. Find contract vehicles, top contracts, your top competitors, top federal agencies, and more.

Better satisfy your market intelligence needs with Federal Compass to find GWACs that align with your business and its goals.